In the field of semiconductors, Japan has a history of 60-70 years. With its profound technology accumulation, Japanese semiconductor enterprises are shining in the world. Ferrotec is the invisible champion of semiconductor equipment components and materials in Japan.

Ferrotec, founded in 1980, is a supplier of semiconductor products and solutions. It has the ability of product development, manufacturing and sales, and has a wide range of business, involving semiconductor quartz products, solar power generation, thermoelectric semiconductor refrigeration materials and devices, etc.

Among them, Ferrotec ranks in the forefront of the world in the field of silicon wafer production equipment. In the vacuum air tight parts market, it accounts for 65% of the market; in the probe plate machinable ceramics, it accounts for 90%. There are many other achievements like this, and Ferrotec is really dazzling.

Among Ferrotec's four major businesses, such as electronic devices and solar cell related products, semiconductor and other equipment related products are the main business, bringing nearly 65% of the company's revenue.

In 2019, Ferrotec's total revenue is 81.614 billion yen, including 52.881 billion yen in semiconductor and other equipment business, equivalent to 3.33 billion yuan.

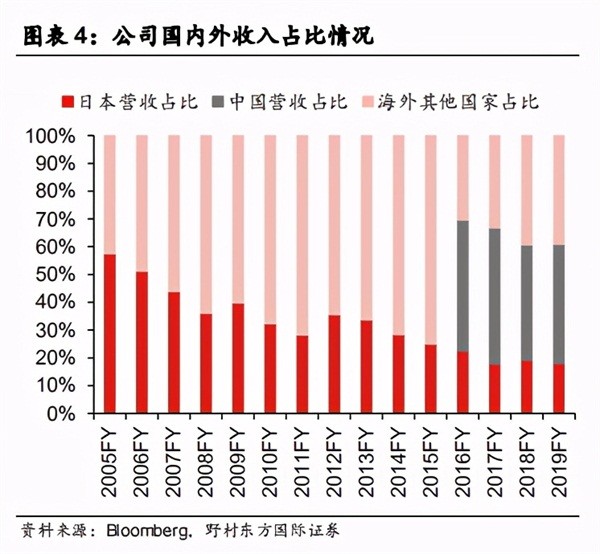

In terms of business structure at home and abroad, China is the main revenue source of Ferrotec.

China is the largest semiconductor market in the world and has a broad market. Moreover, the development of China's semiconductor industry is relatively backward, which gives overseas advanced enterprises huge development space. As a result, Ferrotec has developed rapidly in the Chinese market.

Ferrotec has already entered the Chinese market and set up a subsidiary, Hangzhou Zhongxin wafer, which mainly deals in the R & D and production of semiconductor wafers for high-quality integrated circuits.

Now, the annual production capacity of the subsidiary is 2.4 million pieces / 300 mm, 5.4 million pieces / 200 mm and 4.8 million pieces / 150 mm, and its strength can not be underestimated.

Ferrotec accounts for 40% and 60% of China's semiconductor precision quartz Market and semiconductor equipment and parts cleaning market respectively. Ferrotec is an indispensable partner for Chinese manufacturers.

In fy2019, Ferrotec's overseas revenue accounted for 81.98%, of which China accounted for 42.86%. In other words, Ferrotec can earn 34.979 billion yen a year from China, equivalent to 2.2 billion yuan.

Through Ferrotec, the leading semiconductor company in Japan, we can see Japan's dominant position in the semiconductor field. In the global silicon wafer Market in 2019, shinyue chemical and sumco, two major suppliers in Japan, occupied 51.84% of the market.

At the same time, there are 14 key semiconductor materials in Japan, accounting for more than 50% of the world's total.

In the two major fields of semiconductor equipment and materials, Japanese enterprises are shining in the world. This makes China have to rely on Japanese enterprises in many semiconductor market segments, which is worrying.

Fortunately, the leading domestic semiconductor enterprises are catching up and are expected to break the monopoly of Ferrotec and other Japanese enterprises.