On September 15, when the US sanctions against Huawei came into effect, Ferrotec holdings, a Japanese semiconductor silicon wafer maker, announced that it would sell 60% of its mainland semiconductor silicon wafer subsidiary to the local government of the Communist Party of China.

Ferrotec's subsidiary sold this time is Hangzhou Semiconductor Wafer Co.,Ltd.(FTHW). After the sale, there may be no performance correlation between Ferrotec and FTHW.

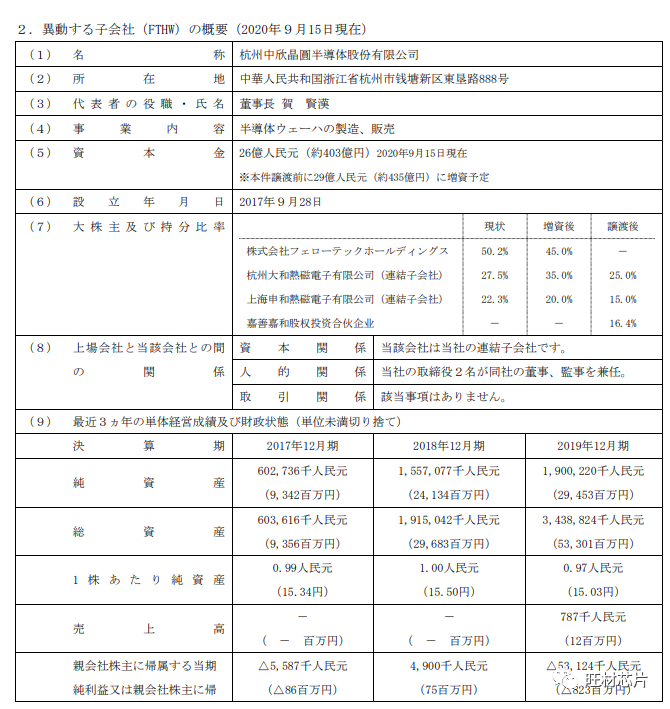

Ferrotec said in its announcement on September 15, "on the premise that FTHW, the core subsidiary of its semiconductor silicon wafer business, will be listed in China's stock market, it has decided to sell fthw to local government and private investment funds in China, and will sell 60% of fthw's equity to the above-mentioned objects at a price of about 29.6 billion yen. After that, fthw will be sold May become a non performance linked object.

Ferrotec shares surged 3.76% on the second trading day (September 16) when it announced the sale of its subsidiary, reaching an eight month closing high.

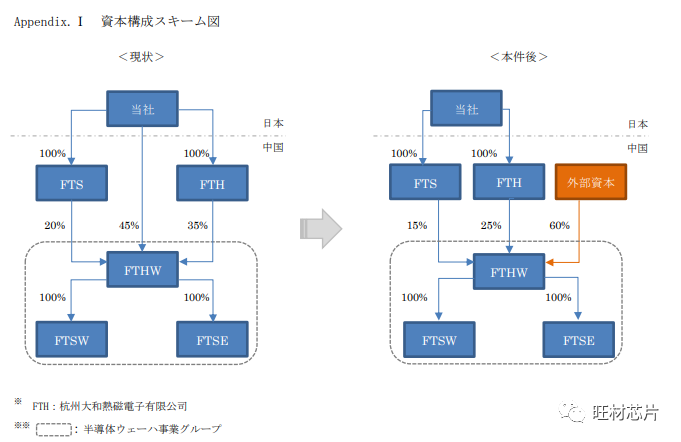

According to the official announcement, we can see the change of capital structure before and after the band trading:

Explanation of abbreviations in the figure: when company: Ferrotec Japan Co., Ltd. FTS: Shanghai Shenhe thermal magnetic Co., Ltd. FTH: Hangzhou Dahe thermal magnetic Electronics Co., Ltd. fthw: Hangzhou Zhongxin wafer semiconductor Co., Ltd. FTSE: Ningxia Zhongxin wafer semiconductor Co., Ltd. FTSW: Shanghai Zhongxin wafer semiconductor Co., Ltd

About Ferrotec

Ferrotec was founded in Japan in 1980. It was originally a subsidiary of an American company. Seven years later, Ferrotec broke away from its American parent company in 1987 and set up a factory in Japan. Ferrotec entered China in 1992 and went public in 1996. In 1999, a friendly tob acquired the former parent company of NASDAQ market in the United States.

Ferrotec began to enter the mainland market in 1992 and has invested in Shanghai, Hangzhou, Yinchuan, Anhui and other places. Just last May, Ferrotec also said that it would continue to increase investment in the mainland, when Ferrotec's share price was falling.

The main products are semiconductor substrate, magnetic fluid, vacuum sealing, quartz products, ceramics, etc., which are used in the current electronic industry, automotive industry, consumer electronics, medical equipment and mobile communication equipment.

About FTHW

If chip burning is a gorgeous dance of integrated circuits, then silicon wafer is the stage to carry it. FTHW is the stage builder, mainly engaged in the R & D and manufacturing of semiconductor silicon wafers for high-quality integrated circuits. FTHW, which was launched in Qiantang New Area in September 2017, fills the gap in the manufacturing of integrated circuit industry in Hangzhou, and is also the largest semiconductor wafer manufacturer in China.

"The demand for large-size semiconductor wafers in the Chinese market is very large, but now the domestic market can only meet 4-6 inch wafers, 8 inch wafers and high-end 12 inch wafers. The independent supply capacity is weak, mainly relying on imports." FTHW is aimed at this market.

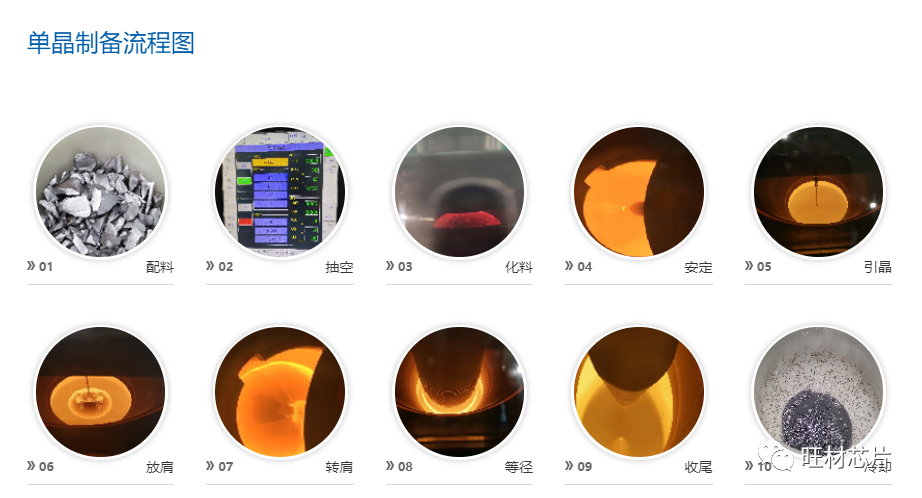

At the end of last year, FTHW announced the successful trial production of 12 inch wafers, which is another key production capacity progress after 8 inch wafers. At present, FTHW has realized the complete production from single crystal silicon rod drawing to 100 mm-300 mm wafer processing. Now it has 9 8-inch (200 mm) production lines and 2 mature 12 inch (300 mm) production lines. It is worth noting that the 300 mm production line is the first semiconductor silicon wafer production line with core technology in China.

Why is it sold now?

Ferrotec's announcement came on the day the US sanctions order against Huawei came into effect. According to the sanction order, any foreign enterprise that uses us technology and equipment must first obtain us permission if it wants to supply goods to China.

Subsequently, a number of large semiconductor companies in Japan, including Toshiba, Kaixia, Sony and Mitsubishi Electric, announced that they would stop supplying products to China from now on.

Recently, with the aggravation of trade friction between the United States and China, the government said that it would achieve 70% chip self-sufficiency rate by 2025, and the trend of semiconductor localization is more accelerated than before. The objects of localization include not only semiconductor manufacturing devices, but also the localization of components and materials for semiconductor manufacturing, especially IC. As the main components of trawl, semiconductor chips are almost dependent on imports, so they are self-sufficient and strongly demand higher interest rates. Among them, 300 mm semiconductor chips are mainly used for memory logic. Therefore, the government has also strengthened various kinds of support such as tax incentives and subsidies for strategic domestic products.

At the same time, the semiconductor chip business needs a huge amount of equipment investment, which has a great impact on Ferrotec group's finance. The introduction of external capital is also of great benefit to the company's business expansion.

In this case, as the group, under the preferential policies of the Chinese government, it is natural for the group to increase production and attract more talents for its future development. The result is to solve the problems of financing and talent management with the goal of listing FTHW in China's stock market.

The announcement also said details such as the listing date have not yet been determined. According to the changes in the industry environment and the results of consultation with fthw's capital partners, it is also possible to draw the conclusion of not listing.